tl;dr summary here. But you should read the entire post.

Inequality in the Internet Age

Inequality has increased since the 1970s. The share of national income and the total wealth that goes to the top 10%, 5%, 1%, .1% and .001% has has gone up. And it continues to go higher. We haven’t seen levels like this since the Gilded Age.

The top 10% now owns 61.9% of all US wealth, up from about ~50% in 1989, while the next 10% now owns 11.9% and the bottom 80% now owns 26.8%, down from ~37% in in 1989. The top .1% owns the same as the bottom 90%, about 22% of net household wealth for the first time since pre-WWII. We’re experiencing a massive shift in wealth. And it’s getting redistributed up the ladder.

Most of the increased wealth and increased income has gone to the very top end of the ladder. As presidential candidate Bernie Sanders said in a tweet, “since the Wall Street crash of 2008, more than 58% of all new income has gone to the top 1%.” As Catherine Rampell says in the New York Times, “…much of the rise in inequality over the last few decades has been because of the increasing inequality isolated among the very top members of the income distribution, as America’s wealthiest have pulled further and further away from their slightly less wealthy peers.”

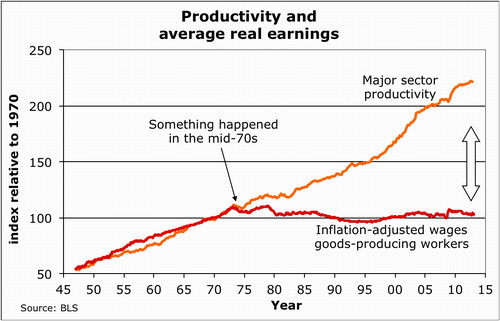

Inequality is going up. The rich (and especially the super rich) are getting a higher percentage of national income and controlling a higher percentage of the national wealth. See the above chart. Middle class incomes are falling in real terms, along with middle class wealth.

And it’s not just a recent phenomenon since 1999. It’s been happening since the 1970s.

Something important happened in the 1970s. Productivity was decoupled from wages. The bottom end of the spectrum started to lose in real terms and grains from increases in productivity went to the highest earners and the owners of capital. According to The Economist, “since 1970, productivity has more than doubled in the US while median incomes rose only 11%.”

As GDP has boomed, growth hasn’t translated into gains for the middle class. The 2014 real median income number is 6.5 percent below its 2007, pre-crisis level. It’s 7.2 percent below the number in 1999. And as the NYT rightly states, “you can’t feed a family on GDP.”

It’s easy to say the middle class has been left behind. And it has. But in reality, remembering the graph above, while the top 10% has left behind the bottom 90%, the top 1% has left behind the 10% and the .01% have left behind the top 1% and the top .001%, or about 400 families, have left behind the top .01%. To the point that the top .001% have a different, private tax system that saves them billions of dollars per year, mostly via arcane tax court rulings and backroom negotiations.

I see the US getting closer to a traditional Latin American distribution that we in the US like to laugh at as being “banana republics.” In reality, in terms of inequality the US is closer to being Chile, where I’ve lived for the past five years, than it is to being Germany, Netherlands or Belgium. And wealth inequality in Chile and other Latin American countries creates massive problems in these societies. I’ve seen them first hand. And I don’t want the US to end up like these countries.

Why do we have more inequality? Why is this happening?

I believe inequality has three main causes:

- New technology allows for winner take all/winner take most distributions in markets where it previously wasn’t possible

- Current government policy favors capital, the rich and especially the super wealthy, over small business and the rest of us

- A high concentration of wealth that allows the wealthy to live apart from the rest, thereby losing empathy and blaming us for our problems

Technology Allows for Unprecedented Wealth Accumulation via Siren Servers and Network Effects

Lets unpack technology first. Paul Graham says technology since the 1970s “has made it much easier to start a new company that grows fast.” He’s right. Technology has allowed people to start businesses for cheaper and more quickly than ever before. It’s also allowed them to capture markets on national and global scales that both improve end user customer experience, but also decrease the need for labor, by a factor of 10 times, 100 times and sometimes even potentially a million times. And do it extremely quickly.

But Graham doesn’t account for the fact that unlike other times in history when large companies dominated entire industries, they still employed thousands or millions of people and might only have been able to dominate certain geographic areas. Not because they wanted to, but because they had to because of available technology. Now, most successful companies act as Siren Servers or exploit massive network effects. As I wrote back in 2013:

Siren Servers suck all data and a vast majority of profits, putting traditional businesses out of business and concentrating wealth and power in the hands of a small, elite few. Instead of paying people in dollars for their data, siren servers pay them in candy or lower front end costs. They convert industries that used to have a bell curve distribution into industries that have winner take all, star systems.

Wall Street is currently the most egregious example of a Siren Server, sucking up vast amounts of financial data to arbitrage or gamble for massive profits, with no downside when it screws up. Most people have an easier time recognizing the problem that Wall Street’s current model create, but the reality is that many tech companies act the same way: gamble or arbitrage without taking on risk. Most new tech companies use this business model, taking what used to be bell curved shaped markets with many winners and turning them into logarithmic, winner take most/winner take all markets.

- Instagram – Takes your data in exchange for taking photos, putting filters and sharing them.

- Twitter – Takes your data in exchange for connecting with friends and reading the news.

- Foursquare – Your location data in exchange for restaurant reviews and social networking

- Facebook – Takes your data in exchange for being able to brag about yourself and stalk your friends.

- Amazon – Give us your reviews for free and purchase data and we’ll give you lower upfront prices.

- Huffington Post, Medium – Give us your content for free or very cheap and we’ll give you “exposure.”

- Google – Use gmail, google docs, search, browser, android, blogger, youtube, calendar, google plus for free, in exchange for using your data.

When we combine lower costs, the ability to scale quickly and Siren Server business models that are only possible now because of technology, we get massive increases in inequality. People like Paul Graham claim that this is the natural order of things, that we just need to get used to an extremely unequal world. But others like Jaron Lanier trace our path to real choices that people made back at the start of the internet. And real choices that, while very hard to make, we can still make today.

Government Policy Favors the (Ultra)Rich

Technology itself is currently set to create massive inequality. But government policy, especially tax policy, puts the inequality created by technology on steroids. The top .001% have their own parallel tax system. Companies like Apple, Facebook, Uber, Twitter, Airbnb and others have created completely legal tax structures that route profits via multiple countries (doing the Double Irish, Dutch Sandwich) and end up in tax havens like Bermuda where they can suck profits out of where they were earned. These structures are so complex that small and medium sized businesses don’t have access to them, meaning they pay full corporate tax, making an already unlevel playing field even more unfair. When these loopholes are threatened, Silicon Valley “squeals like stuck pigs” to preserve them.

When capital does well, it’s taxed at lower rates. Wall Streets is the biggest culprit here, with the grossly unfair “carried interest” tax loophole that allows hedge fund managers to pay capital gains tax of ~20% instead of income tax of 39% on their income. VCs and startup founders have similar loopholes. Mark Suster explains the tax advantages for capital extremely well in his post Why I Don’t Celebrate Income Inequality.

More recently, extremely low interest rates have allowed those with access to large amounts of capital (big banks, wall street hedge funds) to borrow huge sums of money and lend it out at higher rates, arbitraging massive profits and inflating away the middle class’ savings.

Uber As An Example

Uber is an interesting case that epitomizes the new winner take all, tax avoiding, siren server company in the internet age. Uber is clearly better for the end consumer in the short and medium term. My life is clearly better when I use Uber: I can hail a safe, clean taxi pretty much anywhere in the world, pay with credit card, not get taken for a ride and get my receipt to my email etc. But the downside is that Uber takes between 10-30% commission for itself and as Uber expands and kills other competition in this winner take all/most market, an ever increasing percentage of local taxi transportation revenue that would have stayed in the local economy is now transferred to Bermuda via Ireland via the Netherlands and Ireland again into the hands of a its cofounders and early investors. And when (not if) self driving cars happen, Uber or potentially Telsa will eliminate the drivers and take 100% of the transportation money out of the local economy. And it’ll never return.

Uber isn’t an isolated example. We’re on the brink of the Sirenization of many industries and I don’t see how at scale nearly all industries won’t fall into this format.

Consequences

It almost like people with no place in future angry about it. – Fake Grimlock

As technology enables people to build companies that take advantage of the winner take all model, both in finance and in startups, larger amounts of money go to the ultra wealthy. As Charles Murray shows in Coming Apart, our extreme income inequality has led to a small, super rich upper class that’s both physically and culturally separate from the rest of the population, similar to Latin American and other oligarchical countries.

He argues that the magic of the US up until the 80s and 90s was that people of different economic classes lived and worked together. They got married. They shared experiences. The rich banker lived near the police officer, the janitor and the teacher. And the rich banker saw that the janitor and teacher worked really hard and wanted the same things as he did. So when the janitor or teacher had problems, the banker was much more likely to empathize, because he interacted with them on a day to day basis, as humans.

Now, elites live in Super Zips, enclaves that are in the 95th percentile or higher for income and education. They don’t interact with non elites on a daily basis. Unless is a service relationship like a waiter, housecleaner or Uber driver. This lack of contact makes elites less likely to believe that the non ultra wealthy are working hard, struggling and have legitimate concerns. It makes them think they’re brilliant. It leads to high end plutocrats and some well meaning elites to justify the current inequality as a pure meritocracy. And it leads to essays like Paul Graham’s tone deaf blog post.

It leads to political polarization, too. “Would you be upset if your child married a supporter of a different party from your own? In 1960, only 5 percent of Americans said yes. In 2010, a third of Democrats and half of Republicans did,” according to the Atlantic. And cultural polarization, as Adnad Giridharadas says in his TED Talk:

“If you live near a Whole Foods; If no relative of yours serves in the military; If you’re paid by the year, not the hour; If no one you know uses meth; If you married once and remain married; If most people you know finished college; If you aren’t one of 65 million Americans with a criminal record. If any or all of these things describe you, then accept the possibility that, actually, you may not know what’s going on, and you may be part of the problem.”

If the US keeps trending toward more inequality and influential people like Paul Graham and most people on Wall Street keep cheering the process without regard to the people that are being left behind, the US will trend more toward a Latin American style banana republic with a different justice system for people with money, different tax systems and a true loss of the American Dream for the vast majority of the country. Some would argue that it’s actually killing the bottom 20%, with white women in that income quintile losing 5 years of life expectancy since 1990, mostly through drug/alcohol abuse, obesity, suicide etc. A literal loss of hope.

Donald Trump and Bernie Sanders are just starting to tap into this anger, panic and pain felt by those that are getting left behind. Unfortunately Trump is doing it with a racist, xenophobic, anti-intelect campaign that doesn’t target the root causes: technological change, the plutocracy, government policy and increasing inequality.

I’ve lived where the US is going for the last five years: Latin American style inequality, oligarchy and plutocracy. It’s not what I want for the US. It’s not what the vast majority wants for the US.

We can still make changes. We’re still not too far down the path that we should just give up and “live with inequality” as Graham posits. We can have startups, innovation, a functioning financial system AND less inequality. It will require hard work, elites to realize they’d benefit from thinking more like Nick Hanauer, reexamining the social contract and probably lots of time, but it can be done.

Because if we keep down this path, there’s really only a few logical ends, none of which are pleasant for anyone besides a few scenarios where the ultra wealthy end up happy and the rest of us end up wretched.

8 Comments

Be sure to check out this book by Astra Taylor: “The People’s Platform: Taking Back Power and Culture in the Digital Age”

http://www.goodreads.com/book/show/13168201-the-people-s-platform

She raises some tough questions that I’ve seen few others try to answer, let alone ask. Your post is one of those very few.

Edit: looks like you’ve been ahead of this for awhile now –> http://nathanlustig.wpengine.com/2014/04/08/why-have-job-killing-tech-startups-gotten-a-pass-from-public-outrage/

Thanks, will check it out. You might also like this post of mine for 2+ years ago:

http://nathanlustig.wpengine.com/2013/10/28/how-the-future-might-look/

OK, I read the whole thing. I agree this is important. It is happening, it’s bad, and it is getting worse. I have two points. First, Chile, like other Latin American countries, is a relatively small contained market in the international scheme. They really don’t compete with outsiders and inside is a fixed game. The elites get to stay in charge and stay rich. I think that would break down pretty fast if they were exposed to the Costcos, Walmarts (not the Lider affiliate) and other major league competitors. But because of the small market and the probable lack of return on investment for them, they are not much of a threat, and the locals can continue to avoid changing until violence and revolution becomes the only hope for the masses. On a scale of world trade that the US and other larger trading countries compete in, there is a curve on which fewer and fewer customers can participate as their incomes decrease. At some point the lack of participation will reduce the benefit of the elites to ignore them. This of course not even considering the social and political consequences that always accompany these cycles.

My second point is that people participate in this system willingly. Yes, it’s true that technology is a force multiplier for business, but the idea of social media, with some exceptions, is a time wasting drug that enables the entire concept of siren servers. Like drugs, a little makes you feel good. Too much or too often makes you degenerate. The influence of the marketers defines the market. Pop culture is a huge influence that increasingly distorts values. Historically, churches provided the centering influence. But religion has given way to the market. Movies, streaming, music, fashion, and more are all feeding the same marketing beast and it’s informed by the data that tracks it. Until people understand that and find and prefer more useful and fulfilling ways to occupy themselves (and I’m not holding my breath for that to happen), the unhappy trend will continue until a tipping point or Black Swan event causes an as yet unforeseen course change. OK, Im done.