In the startup world, success always attracts copycats and competitors. As a result of past successes, Latin America’s food delivery industry is one of the most competitive in the world. Brazil’s iFood, a subsidiary of tech giant Movile, became one of the biggest players in the Latin American startup ecosystem, raising US$500M from Naspers and other international investors, in what many consider to be the largest round in Latin American startup history. iFood is growing incredibly quickly, registering 390,000 daily deliveries, a 109% increase from 2017. iFood’s CEO, Carlos Moyses, recently appeared on my Crossing Borders podcast to talk about the growth of Brazil’s biggest delivery company.

Rewinding back to the early 2010s, food delivery in Latin America had its first peak long before the region truly went digital. Latin America’s food delivery hit the news because Delivery Hero, a German food delivery conglomerate, secured international reach through a spate of acquisitions in the region.

In many ways, these deals spurred the next generation of entrepreneurs in the food delivery space and created many of the most popular apps Latin Americans use today.

Food delivery fits into a trend that is shifting Latin American shopping patterns online. When PedidosYa was founded in 2009 in Uruguay by Alvaro Garcia, Ariel Burschtin, and Ruben Sosenke, just 27% of Latin America’s population had Internet access.

Today, 66% of Latin Americans have Internet access, and in Argentina, Chile, Brazil, Ecuador, Paraguay, and Uruguay, more than 70% of people are Internet users.

An overwhelming proportion of these users are connecting to the Internet via a smartphone, meaning delivery apps are now competing for a market of over 236 million potential customers. In some countries in Latin America, smartphone adoption is still accelerating at more than 15% per year.

Colombia’s Rappi is the newest member of the Latin American delivery startup club gaining international attention, recently raising $200M at a $1B valuation.

These startups are competing against global companies like UberEats and Spain’s Glovo, both of which operate in Latin America as well.

Let’s take a look at how delivering Latin America’s take-out become such a cutthroat industry, starting at the beginning with Delivery Hero.

The Delivery Hero acquisition boom

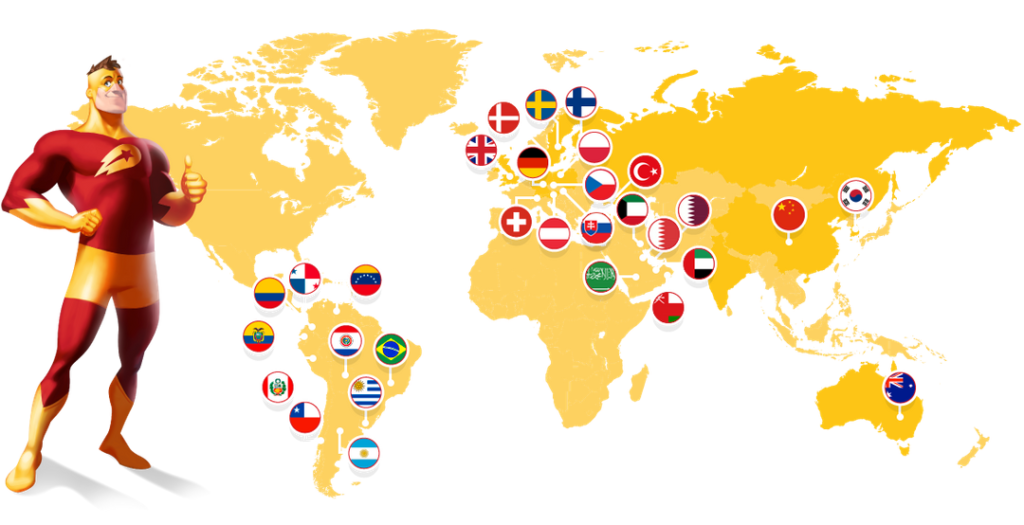

Delivery Hero’s presence around the world before its IPO in 2017.

The Delivery Hero Group was founded in 2011 in Berlin, Germany as a pivot of founder Niklas Östberg’s previous food delivery business in Sweden. The company competed on a global scale through an active M&A process that led to acquisitions in Europe, Asia, and Latin America.

In its first year in business, Delivery Hero acquired five startups in Europe. After raising several large, successive rounds, Delivery Hero raised an impressive US$350M in 2014 from previous investors and Vostok Nafta. This round was the largest for a European startup since 2009.

That funding allowed Delivery Hero to expand into the Latin American market, its next move after Europe.

Delivery Hero landed in all of Latin America’s major cities almost overnight through its acquisition of PedidosYa, the clear market leader in the region. However, as with other Delivery Hero acquisitions, PedidosYa kept its name and brand, rather than adopting the German brand’s image.

In the same year, Delivery Hero also acquired ClickDelivery, a Colombian startup founded by Jose Calderon, Miguel Allister, and Pablo Gonzalez with operations in Peru, Chile, Puerto Rico, Argentina, and Ecuador.

Outside of Latin America, Delivery Hero started its Asian expansion with the acquisition of Baedaltong in Korea and consolidated its hold in Germany by purchasing Pizza.de.

Even in 2014, Delivery Hero’s subsidiaries faced fierce competition in the Latin American delivery market.

A 2013 article in PulsoSocial revealed the who’s who of Latin America’s delivery companies, including seven startups that were already operating in three or more countries across the region.

At the time, Brazil’s iFood (founded by Patrick Sigrist and several others and later acquired by Movile) was already actively acquiring competitors.

Also during this time, HelloFood, backed by Delivery Hero’s main competitor, Rocket Internet, already acquired three competitors.

Argentina’s SinImanes, founded by Ignacio Gugliegmetti, had also established a partnership with Mexico’s SeMeAntoja to attack the mobile side of the industry. So for a brief period, the market consolidated.

Delivery Hero acquired HelloFood (also known as Foodpanda) for US$500M in 2016. At the same time, Movile invested US$30M in iFood to gain a 60% controlling stake in the company.

The companies became a part of a tangled web of acquisitions and investments that tied together iFood, Just Eat, HelloFood, SinDelantal, and SpoonRocket (USA).

This flurry of deals came just as global investors had given up on food delivery, seeing no long-term sustainable business model for the industry.

Food delivery startups worldwide were seeing VC money dry up and valuations slashed, yet in Latin America, food delivery kept growing.

Mumbai’s pioneering delivery startup TinyOwl, Sequoia Capital-backed PepperTap, New York’s Maple, and San Francisco’s Sprig and Spoonrocket were just a few of the startups that closed or ran out of cash during 2016-2017.

During the same time, Chile’s QueHambre was acquired by PedidosYa for almost US$1M, despite having only two employees. QueHambre’s founders went on to build Fintual, Chile’s first Y Combinator company, using some of the payout from the acquisition. However, QueHambre came close to shutting down several times during and before the deal.

Out of the ashes came the most recent generation of delivery startups, which have fine-tuned their offerings for the Latin American market. Delivery Hero continues to expand and invest actively in the region, but it has yet to acquire any of the latest top players.

The leaders of Latin America’s second food delivery revolution

Anyone who pays any attention to the Latin American startup ecosystem knows Rappi, Colombia’s standout delivery startup that became the country’s first startup unicorn in September 2018. Founded in 2015 by Simon Borrero, Felipe Villamarin, and Sebastian Mejia, Rappi expanded rapidly across the region and now provides services in six different countries.

Their business model of charging the equivalent of just one dollar to deliver almost anything, from cash to dog food, gained the attention of Y Combinator in 2016. Rappi was the first Latin American startup to enter the prestigious accelerator.

As with PedidosYa’s success, Rappi’s growth goes hand-in-hand with the second-coming of Latin America’s delivery startups.

New startups enter an already-crowded space, as most of the players from the early 2010s are still active in their markets. Beyond the international presence of Delivery Hero, Rocket Internet, and Naspers, massive global apps like UberEats and Glovo are also expanding rapidly in Latin America.

So why is this market still so hotly contested in Latin America when investors worldwide seem to have given up on food delivery?

Mercadoni founder Andres Nunes explained this phenomenon when he appeared on my podcast earlier this year:

“It all comes down to the unit economics of the region. It is very affordable to have things delivered in Latin America as compared to the US or Europe. In Latin America, getting something delivered costs US$2-3, while in the US it costs closer to US$15. Someone has to foot those costs, and in more developed markets, that really eats into your margins.”

Andres knows a thing or two about e-commerce and delivery businesses. While he worked for Germany giant, Rocket Internet, he founded and developed several e-commerce businesses across the world, including Linio, the “Amazon for Latin America.”

Linio was recently acquired by the Chilean retail giant Falabella for US$138M to improve their e-commerce capabilities.

Andres sees the high level of competition in the Latin American delivery industry as a sign of its value; the presence of competitors validates the fact that there is money to be made.

The current players

Here are a few of the most prominent startups currently competing for a piece of Latin America’s food delivery market.

iFood (Brazil): Latin America’s largest delivery app, backed by Movile and Naspers. iFood processed 12M orders in November 2018 alone – more than 16x more than their nearest competitor. iFood also recently raised US$500M from Naspers and Innova Capital.

Rappi (Colombia): The standout delivery app that brings almost anything to your door for a flat fee with operations in Colombia, Brazil, Argentina, Chile, Uruguay, and Mexico. Rappi was valued at US$1B after receiving a US$200M investment in September 2018. Delivery Hero led Rappi’s Series C investment in January 2018.

Cornershop (Chile/Mexico): A grocery delivery app that came from the previous founders of Groupon LatAm, the so-called Groupon Mafia. Cornershop was recently acquired by Walmart for US$225M.

Mercadoni (Colombia): A grocery app that provides “hyperlocal” deliveries in Latin America in under one hour. Mercadoni raised a US$9M Series A round from Movile in 2018.

Glovo (Spain): The food delivery app that spun out from Spain’s Cabify arrived in Latin America in early 2018. Glovo currently operates in Spain, Italy, Portugal, France, Argentina, Chile, Bolivia, and Peru.

Kiwi (Colombia/USA): Founded by Colombian students at the University of California – Berkeley, Kiwi delivers food via robot on college campuses around the US and Colombia.

Domicilios (Colombia): Previously known as ClickDelivery (acquired by Delivery Hero), Domicilios delivers take out in Colombia, Peru, and Ecuador.

PedidosYa (Uruguay): After being acquired by Delivery Hero, PedidosYa continues to be one of the market leaders in LatAm food delivery. Over 15,000 restaurants over 400 cities in Latin America use PedidosYa to deliver their food.

UberEats (USA): Uber’s entry into Latin America has been a fraught one. UberEats is currently only available in 11 cities in Latin America across Chile, Colombia, Costa Rica, and Brazil.

These are just the most active players in the Latin American food delivery industry. As in any highly competitive market, there are dozens of smaller actors vying for market share or a strategic acquisition by one of the dominant startups. Now that these companies have tens of millions of users, the next battlefield will be on payments, on top of Movile’s iFood and Rappi Pay.

The companies that are seeing the most success are active in seeking M&A processes with their competitors to consolidate across the region.

This second flurry of delivery startups is already starting to conglomerate, much like the first companies did in 2015-2016, as key players Movile, Delivery Hero, and Rocket Internet start investing and acquiring the latest generation of delivery companies.

It’s never been easier to get food delivered to your home in Latin America. From groceries to take-out, Latin America’s delivery startups are racing to gain market share and attract international attention.

Rappi and Cornershop are proof that the most successful delivery startups are those that mold their model to the Latin American market, taking advantage of local unit economics and smartphone penetration.

If global investors have lost interest in delivery in developed markets, emerging markets like Latin America are still open for business.