My previous post from Saturday generated the most feedback of any of my posts so far. I received tons of emails from some people who agreed and others who thought I was full of it. I’ll try to clarify and expand further with this post.

The Business School Way of Life

John Talton’s recent article on britannica.com called “Business Schools & Financial Services: Oh The Harm They’ve Caused” is a great article on a subject that I have been meaning to write about for awhile now. Talton’s main premise is that:

…for a generation or more…so many of our brightest college graduates have gone to Wall Street to get rich, rather than creating something useful or beautiful, rather than helping to strengthen and reinvent industries that actually produce something. Those with less talent, connections or family money have mimicked them, choosing to work in “financial services.”

Tellingly, they are enrolled in highly publicized “ethics” courses. And year after year, the top graduates go into finance. Most graduates move into settings where they continue their socialization into being an unquestioning cog in the matrix. The motivation is at once banal and uniform: I’ve talked to many classes where students say their main goal in life is to “get rich.”

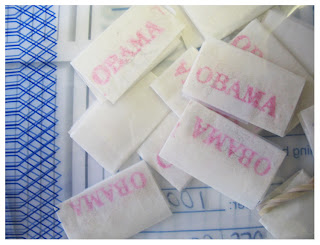

The Audacity of Dope

I shamelessly pulled this headline from The Smoking Gun because I couldn’t do any better. Apparently drug dealers in New York were selling Obama brand Heroin. Other brands were “bin Laden heroin,” “Harry Potter Ecstasy,” and “green tinted crack for St. Patrick’s Day.”

Like I said in my previous post, its too bad that these guys’ creativity isn’t being put to better use. Imagine what they could do with a 30 second spot for the Superbowl…

How Much Does A Hustler Make?

Sudhir Venkatesh’s book Off the Books: The Underground Economy of the Urban Poor will tell you the answer.

I just finished reading it this week and while it wasn’t as engaging as his previous Gang Leader for a Day, it was informative. It profiles how “hustling” is a necessary part of life for many in the urban poor. He spent over 10 years “hanging out” on the South side of Chicago and got to know many of the people who lived there. He takes the experiences of prostitutes, drug dealers, ministers, auto mechanics, the homeless and petty thieves and weaves an interesting tale of how marginalized people use their entrepreneurial skill to survive.

While it can be dry and times, and Venkatesh seems to repeat himself in some of the chapters, the book is worth reading. If you haven’t read Gang Leader for a Day, I would suggest reading it first, as its a much better intro into Venkatesh’s work than Off the Books.

You have to admire the entrepreneurial spirit that many of people in the book display. The traits that many of the “hustlers” have are the exact traits that many startups are looking for: innovation, willingness to change business models quickly and operating without significant cash. It would be great if there were a way to harness their willingness to take risks and come up with solutions on the fly in other, more productive ways that would allow the marginalized hustlers to live a better life.