Una versión de este post fue traducido a español por @Joseia (muchas gracias!) y apareció en Pousta con el nombre Conversamos sobre cómo montar tienda online con alguien que aprendió DEMASIADO al respecto.

In late 2012, I met up with two ex startup chile friends over beers. Like most beery conversations between entrepreneurs, the conversation devolved into new business ideas. All three of us had seen ecommerce’s steady growth in Chile and were certain that it would continue to grow toward levels seen in other developed markets. After a few more beers, one of us said, “why don’t we just start a small ecommerce business, it’s the best way to learn about the market and see where the real opportunities are.”

That conversation led to more conversations and we got serious about launching a small ecommerce business to really get a handle on the market. But what product should we sell? And how would we validate the market to know if the product we wanted to sell made sense? And how would we do it without spending huge amounts of money?

I’m writing this post to shed light into our thought process and to show how we validated our ecommerce business without spending a single dime (peso in this case) for two reasons:

- To give an overview of Chilean (and Latin American) ecommerce opportunities

- To help other entrepreneurs think about how they can validate their own ideas without spending months and thousands of dollars buying inventory, developing software and wasting time on unimportant things.

By now, almost all entrepreneurs know about lean startup methodology and try to use it, but the how remains mysterious to a high percentage of entrepreneurs. I hope this post is useful.

Preview: tl;dr (Too Long Didn’t Read)

After much research, we launched La Condoneria, to sell condoms online in Chile. We validated the opportunity by spending less than $100 and didn’t build any technology. We learned a ton, reached $8000 monthly sales and 100k unique organic traffic using Jumpseller, a Latin American Shopify.

We tried to scale by creating our own product or taking representation, but because of regulatory issues based on the product, we decided the best we could do is a small business. We believe that the two best ways to make money in Latin American ecommerce are by having exclusive representation of a product, or creating your own product, a la Warby Parker. We believe there is a massive opportunity in full stack ecommerce startups in Latam.

Step 1. Research

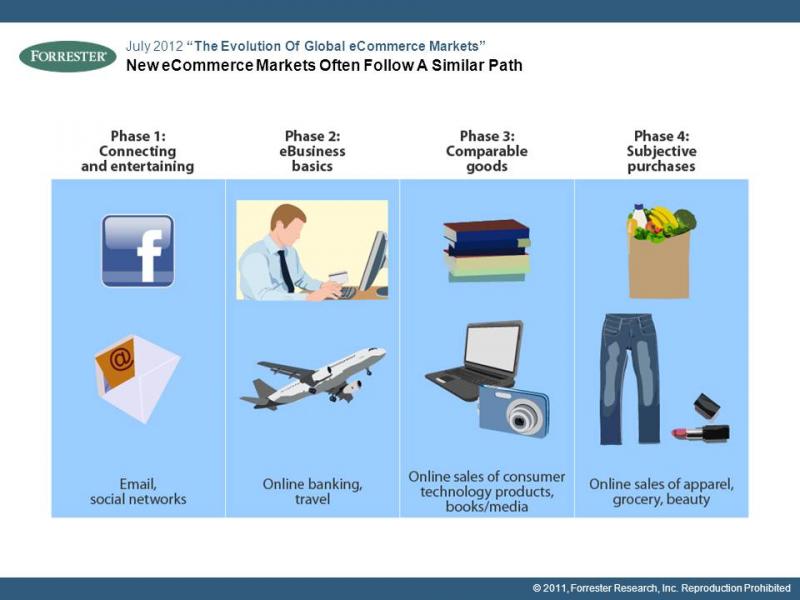

We first wanted to see if countries adopt ecommerce in a predictable manner. We knew that ecommerce in Chile was growing at 30% per year, but the vast majority of people hadn’t ever bought anything online. We found a Forrester report that showed the phases of ecommerce adoption. It corroborated our hypothesis that new markets tended to follow similar paths:

We firmly believed that Chile was nearing the end of phase 2, and the early adopters were already moving into phase three. Chile is young and social, people are comfortable online. LAN airline ticket offices and travel agents were going out of business because of online purchases. We saw early successes like Buscalibre and Clandescuento (acquired by Groupon) and large retailers were starting to sell online. One of our best friends, Tiago Matos, is the founder of Jumpseller, a Shopify of Latin America, and we saw his business taking off. It was clear to us that we were on the cusp of phase three and we decided to go after it.

Step 2. What should we sell? A product? Or pickaxes to the miners?

We made a map of the industry in Latin America and looked at the businesses that make money in ecommerce in the US. By late 2012, we saw seven opportunities in the ecommerce market in Latin America:

- Amazon clone (high volume, low margin)

- Niche products with amazing stories and customer service (Dollar Shave Club)

- Create your own brand (Warby Parker)

- Shopify – Sell the pickaxes to the miners and create the infrastructure

- Payment systems

- Logistics and delivery (dropshipping)

- Get the exclusive representation of a foreign brand (medium margin business, low competition)

We quickly discarded doing an amazon clone because we believed that the Amazon of Latin America will likely be Amazon or potentially Linio, from Rocket Internet, which had recently launched. We also saw Buscalibre potentially struggling and discarded that idea.

We discarded doing a Shopify clone because our friend Tiago was already working on it and having some success. We looked at payments, but although a massive problem, we didn’t think we could solve it. We decided that it was likely that someone like Stripe, Braintree, Paypal or Venmo would use VC funding from the US to attack the Latin American market. We looked at selling a commodity product with an amazing story, but decided that if you have a commodity product, in the medium term, your margin will go to zero.

That left us with three options:

- Getting the exclusive distribution rights to a product that didn’t exist in Chile

- Creating our own product from scratch Warby Parker style

- Starting with a commodity product, knowing that our margin would eventually go to zero, with the goal of adding an exclusive representation or our own product after we got clients.

We chose option three for two reasons:

- Creating our own brand was too expensive and time consuming

- Introduce a new brand that people didn’t trust into the equation would be difficult because the vast majority of our potential clients would be buying online for the first time.

Step 3. What product should we sell?

We made a list of 50+ products that we were interested in selling including:

- Diapers

- Condoms

- Brand Name Sunglasses

- Birth Control Pills/tampons

- White label Sunglasses

- Cosmetics

- Pet Supplies

- Eyeglasses

- Men’s personal grooming items

- Disposable shavers

- Perfume

- Women’s Shoes

- Jewelry/Accessories

- Custom Tshirts

- Bikes

- Purses/Wallets

- Wine, Beer

- Tea and Coffee

- Electronics Accessories (iphone cases etc)

- Headphones

- Watches

- Baby stuff

- Women’s underwear

- Artwork

- vitamins

- Soccer jerseys

- Kids Toys

- Home Furniture and Accessories

- Office Furniture

- Custom Shirts

- Backpacks

We created a list of criteria to find the perfect product for us to get start with. Our criteria was:

1. Easy to ship

Shipping in Latin America was (still is) expensive and unreliable for larger products. We needed a small, lightweight product. That quickly eliminated products like furniture, diapers, pet supplies, beer and wine.

2. High margins

We wanted to be in a high margin business, which eliminated all the low margin businesses.

3. Few Returns

Since shipping is a big problem we wanted a product with as few returns as possible.

4. Repeat orders

If we had to struggle to get our first client, and many of our clients would be buying online for the first time, we wanted them to be able to buy again. That knocked sunglasses, bikes, watches, backpacks and artwork off the list.

5. Try before you buy?

Chileans didn’t trust ecommerce, so we wanted a product that you didn’t have to try before you bought, which knocked a significant amount of products off the list.

6. Average cart size

We wanted an average cart size of around $30, which would allow us to give free shipping, but still allow people to buy online without taking too much risk that their expensive purchase wouldn’t arrive.

7. Average item price

We wanted a lowish average price of around $5 so that the buyer would buy multiple items to get to our average cart size, and so that people could buy one cheap item to make their first ecommerce transaction low risk.

8. Market penetration

We wanted a product that was popular, but that you couldn’t find on every corner.

9. Current available selection in Chile

We wanted there to be few choices in the market, so that our product was a commodity

10. Easy access to supply?

Was it easy for us to buy the product to resell? Was it available in Chile? Or did we have to import it?

11. Access to supply outside of major cities

Did people outside of major cities have a problem finding the product?

12. Poor customer buying experience and customer service after sale

Could an online experience be a better than the current offline experience? How was the post sale experience?

13. Potential competition

What did the competition in Latin America look like?

14. Press potential

Could we get into the press with this product easily?

15. Success in the US?

Was it one of the first products that was successful in the early days of the US ecommerce?

16. Do we like it/will it be fun?

One of the most important criteria. It doesn’t make sense to work on something you don’t like, unless you have to.

We scored all of the products and quickly found that there was one product that was clearly better than the rest. It was small, lightweight, easy to ship, didn’t need to be tried on, had zero returns, cost about $3 per product, but could have an average cart size of around $30. It was also a terrible customer experience to buy offline for cultural reasons, had decent margins. We had a contact in the distributor who would help us buy our initial stock quickly and easily. What was the product? After our research, we’d decided to sell condoms online.

Since Chile is a very Catholic country where sex-ed is almost nonexistent, we knew there wouldn’t be much competition and it would be fairly easy to get press. We were also motivated to try to help solve a social problem by providing an online sex-ed resource where scared, young people could learn about one of the most important decisions in their lives. And most of all, it would be interesting and fun.

Step 4. Validating without spending any time or money

Now that we’d chosen condoms based on our research, it was time to validate that people would actually buy them online without us spending thousands of dollars on a website and initial stock. We mapped out a plan and started to execute.

First, we looked on Mercado Libre (Latin America’s Ebay) to see if people were selling condoms online. We quickly found that they were and googled to see if there were any other stores selling condoms online. There weren’t, so we decided to create our own Mercado Libre listings to see if we could get any buyers. We received numerous messages from potential buyers, but we always told them we were sold out, as we didn’t have any condoms to sell them. We’d found that there was a market.

Next, we put up new ads on Mercado Libre and actually made sales. When someone said they wanted to make a purchase, we walked to our local pharmacy, purchased the products and then met the buyer, usually in one of Santiago’s metro stations, to make the exchange. At this point, we didn’t allow online payment or shipping for two reasons:

- We wanted to make the barrier to purchase as low as possible

- We wanted to meet our clients to learn more about them.

We found that most of our clients were young, ignorant, uneducated, scared 15-21 year olds who were clearly going to have sex, many for the first time, and weren’t comfortable buying at the pharmacy.

After about a week and ~5 purchases, we allowed people to pay online with a free instant bank transfer to validate that people would pay online. They did. After another week, we added free shipping and the orders kept coming in. We kept filling them by walking to the pharmacy.

Walking to the pharmacy put us in the shoes of potential clients who we were trying to help: it shined the spotlight on the terrible process we were trying to fix, especially when we had to purchase large quantities of “climax control” condoms for premature ejaculation and XXL condoms at the counter in front of massive lines of people who can hear and see what you’re buying.

Next, we had to validate that people would buy from a stand-alone website outside of the friendly confines of Mercado Libre, so we setup a landing page using Jumpseller with a 99designs logo and send some Facebook traffic to the site. We saw that people were adding products to their cart, trying to buy. We quickly added DineroMail, a Latin America payment processor that charges 7% fees and holds your money for 1-2 months and started to sell online, still filling orders at the pharmacy.

By this point, we’d spent a total of $300 on 99designs, Facebook ads, and postage filling orders. We’d validated that people wanted to buy condoms online, that they’d buy from a site they didn’t know, off Mercado Libre and that we were ready to try to scale the business.

5. Building the Foundation

We decided to spend another $500 for a custom Jumpseller design, purchased $400 of stock of Chile’s three best selling condoms (Lifestyles in case you were wondering), wrote 20 educational articles to get organic traffic and officially launched La Condoneria. We launched with the three most popular brands (Lifestyles, Trojan and Durex) and all 24 popular styles you could find at pharmacies even though we only purchased stock of three styles. We priced the other 21 styles we didn’t have in stock 50% higher than in the pharmacy so that we could see if people were price sensitive, and also because I was sick of walking to the pharmacy to buy condoms each day.

We saw that we had four distinct niche clients and created content and packs for each one:

- Young adults between 15-21 who didn’t know the first thing about sex and were scared to go to the pharmacy – “First time pack” that included a sex-ed pamphlet that helped people decide if they were ready for their first time and if they were, how to be safe their first time.

- Women who didn’t want to go to the pharmacy because of social stigma – Women’s pack, plus dozens of articles about female sex-ed.

- 24-25 year old men who bought 2-3 months worth of condoms at a time to stockup – Pack “heavy user“, a popular 30 pack.

- “Professionals” who were looking for a good price – “Bulk Pack“, a 90 pack, that offered big discounts.

After four months, we’d now purchased all 24 styles and were growing quickly. Our content was incredibly popular, leading to 100k monthly organic traffic, a loyal following and lots of newspaper articles and radio appearances. Our clients loved us because we were really helping people. In a country where most people have incredible misconceptions about sex, abortion in any situation is illegal, getting the morning after pill is very difficult and young people don’t really have anyone to talk to about making this important life decision, we were clearly doing good.

Our live chat was incredibly important for two reasons:

- It became the place for people to go when they had questions about sex and many times we had to refer people to their local clinician or to a specialist to help them solve their problems.

- We could guide people to purchase our highest margin, best products. If we talked to someone on our chat, they converted at around 33%, whereas we had 1% conversion rates on the site.

By the sixth month in operation, we were selling about $5000 per month, but just breaking even. We were convinced that we had found a good niche, learned how to logistics well and know how to acquire clients cheaply, but we needed to explore other ways to up our margin. We knew that if we continued to sell imported commodity condoms, we’d never do better than a 10% final margin, even at scale.

6. New Opportunities for Scaling Revenue

After a few weeks of brainstorming we came up with this list and worked to validate each one:

- Take the exclusive representation of a well know, foreign condom brand and get 65% net margins, up from 10%.

- Create our own white label condom brand and get up to 95% net margins.

- Add high margin sex toys

- Convince local condom brands to advertise on the site

We first looked at taking the exclusive representation of a well know, high quality brand. We had multiple meetings in Santiago with an executive from one of the best condom companies in the world, but in the end, he decided to award representation to another, only offline, Chilean business. We talked to a fast growing, well know, US brand that had already launched in Latin America, but it quickly became clear that they didn’t understand the Chilean market.

They wanted us to purchase a half container’s worth in our first order, and 2 containers worth by year two. Unfortunately, Chile’s entire market only uses about 8 containers per year, so we were being asked to purchase 5% of the condoms sold per year in our initial order and then close to 20% by year three. It just didn’t make sense. As an aside, Chile’s condom consumption isn’t low because Chileans are much less sexually active than their neighbors, they just use fewer condoms (under 1 per capita per year, compared to 5 in Uruguay, 4 in Peru and Argentina.)

Next, we looked at manufacturing our own brand and importing. This opportunity was extremely attractive because the unit cost delivered in Chile was about 2 cents, and the final sale price was about $1.20. Massive margins. But the minimums were high and Chile’s regulatory barriers were almost impossible to comply with. For example, we needed to give the government 10,000 units for testing before we could get the brand registered and we were told off the record that Chile wouldn’t approve a new brand that wasn’t approved in another developed country in the world.

We looked at adding high margin sex toys, but we didn’t think it would work for multiple reasons.

- Japi Jane, a highly successful online sex toy store, controlled the market.

- We weren’t sure that our clients would purchase many toys.

We did some tests using products we’d purchased on Amazon (I brought them to Chile in my luggage and got a letter saying TSA had opened my baggage for extra security checks), but we couldn’t make the numbers work.

We tried to convince local condom brands to pay us, but they all had traditional, conservative views and weren’t interested. The best we could do was to negotiate free samples that we could later sell, but it quickly became clear that this method wouldn’t work in the long run.

After a year in the business, we were selling $8000 per month with 100% free organic and social traffic, making about 10% net margins and it clearly wasn’t worthwhile to keep trying to expand. La Condoneria had turned into a nice small business that will continue to grow, but will never be a massive business.

But it served it’s purpose. We learned everything there is to know about Chilean ecommerce and the massive opportunities that entrepreneurs can attack. We decided to spin off La Condoneria to one of my partners who wanted to operate the business to continue to help Chileans buy condoms online.

The three of us are ready to launch our next ecommerce business taking everything we learned from our first La Condoneria to create a highly profitable business.

6. What we learned

If you’re not going to be Amazon or have millions of dollars of VC to attack payments or drop shipping we believe the opportunities are:

- Focus on creating your own product, a la Warby Parker

- Getting exclusive representation of a product, like our friend Stephen Stynes did with Pouchee.

Delivery, in Chile, for everything except large items is pretty much solved. Payments pretty much work. Infrastructure is well executed with Jumpseller and other competitors, plus Shopify will be moving into the rest of Latam shortly.

From our original list in 2012, many of the ideas have been launched:

- Baby Tuto – $1m+ annual sales of baby products in chile. Have their own branded delivery for large items.

- Obzes – makeup marketplace, closed in 2014, probably low margins

- Briu – Coffee subscription club

- Mangacorta – Custom tshirts, just raised $120k on Broota, a Chilean equity crowdfunding platform.

- Pouchee – Purse organizers

- Linio – Amazon clone from rocket internet

- Dafiti – Zappos clone from rocket internet

- Bike stores – Many

- Dperfumes – Perfume

- Adorate – Women’s underwear, closed in 2014, low margins, hard to sell online.

- Depto 51 – Design marketplace

16 Comments

Great piece Nate. I hope you are well. I have recently built this but not formally launched yet. Trying to define the customer. http://www.prolightpresets.com

Great article, Nate. Thanks for sharing your experience. There´s so much to be done in ecommerce in Chile but the market is pretty small. Any idea on what´s your next step? 🙂

My main focus these days is as an investor at Magma Partners, but am looking at another ecommerce using the lessons we learned from the first one.

Holy crap what a great article!! found it very enlightening.

Thanks marcos!

Question received via email:

Hi Nathan, great article, thanks for sharing, although I do have one question since Im just about to start my own online company; Is La Condoneria actually a society and do you pay taxes for each sale? I know its kind of a weird question, but I have since many online stores that do not pay taxes for the products they sell 🙂 Thanks Regards

Yes, we incorporated as an SpA and pay IVA each month. If you are incorporated in Chile and sell to clients in chile, you need to pay iva, especially if you take online payments via webpay. Webpay is the same as giving a boleta and gets reported to SII, so you need to do it.

If you sell only via bank transfer, you may be able to get away with it for awhile, but if you grow, you’ll have to pay. I would probably no fully incorporate until you’ve validated your business, and as soon as you have, incorporate.

Great article! in my case I developed a plugin for the people that wants to implement the payment system by their own using Woocommerce and WordPress as the base of the system so I saw a lot of people trying their first ecommerce with this. Just in case the plugin is free in https://wordpress.org/plugins/webpay-woocommerce-plugin/

Haha what a great article!, a very interesting analysis of chilean market.

Notable Post!

Great Article Nate! I have just a few months ago opened in Uruguay a shop of sex toys where margins are very high but not volumes as the market is very small. We passed by a similar process of you and met same difficulties with preservatives. I really would like to get in contact with you to see if we can develop a joint project Cile/Uruguay. My email is : [email protected]

Thanks Marco, will connect you with my partner who took over the business.

Wow!

1) Great article; and

2) I am inmmensely tickled to learn you’re one of the guys behind La Condonería XD

You reminded me of something I wrote 10 years ago in regards to this: http://alodoxafobia.blogspot.cl/2005/05/sin-gorrito-no-hay-cumpleaos.html